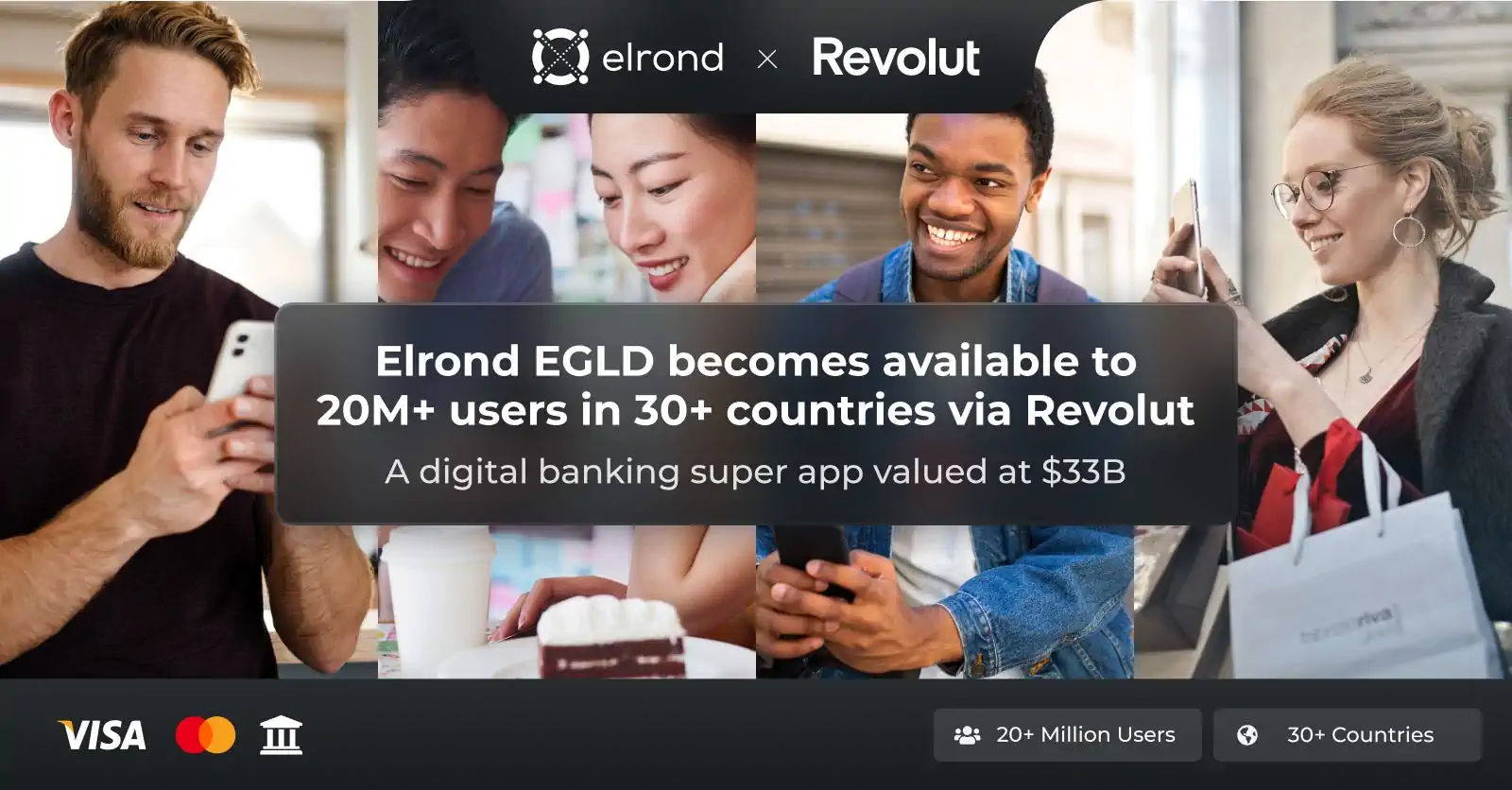

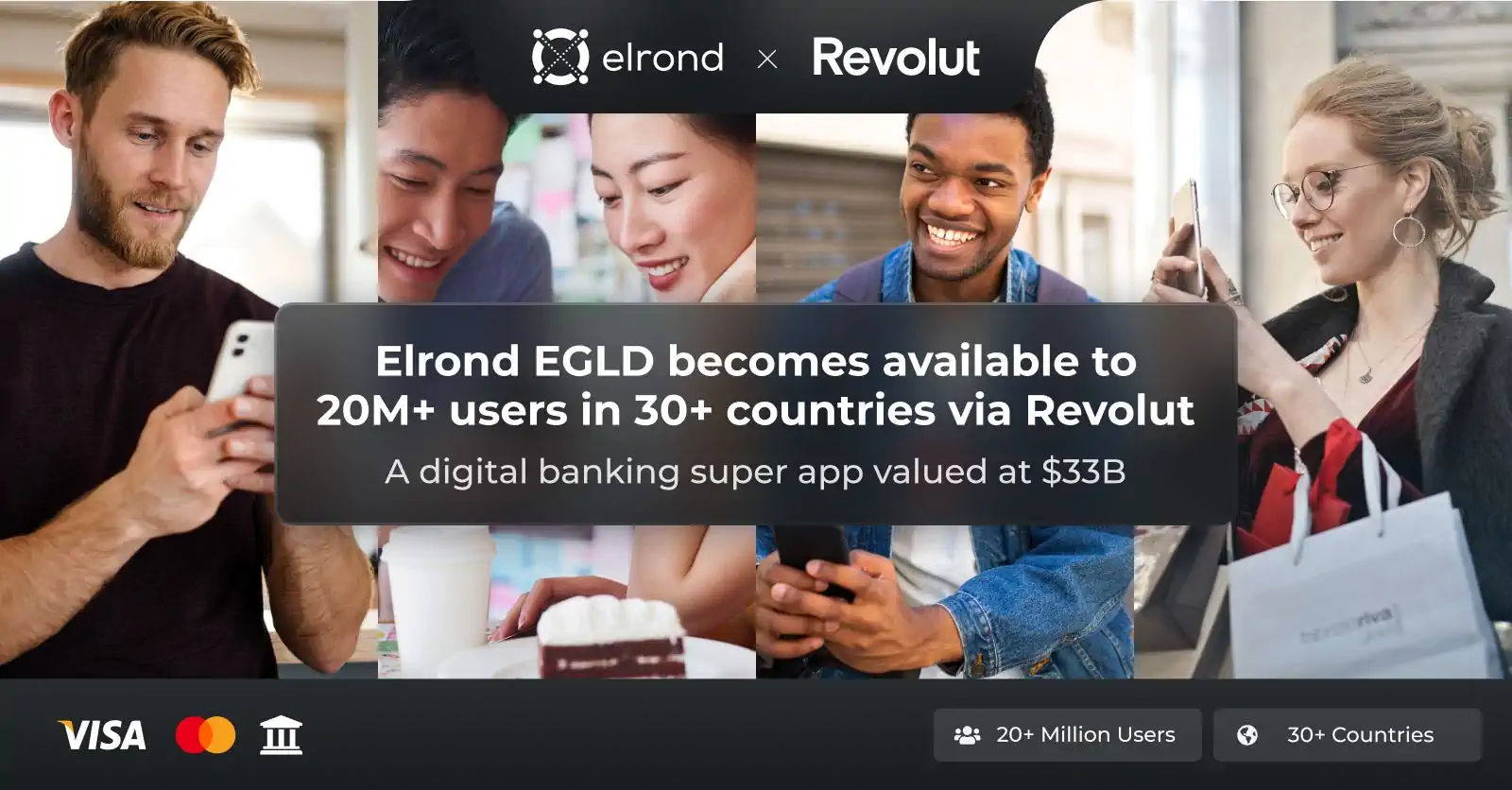

Elrond EGLD becomes available to 20M+ users in 30+ countries via Revolut - a digital banking super app valued at $33B

We are thrilled to announce that the UK-based fintech company Revolut has added EGLD in its own banking app.

Situated at the intersection of traditional and Web3 financial infrastructures, Revolut serves over 20 million customers across 36 countries. With this extended reach, the company can onboard new investors and become the first port of call for those seeking to own and trade digital assets.

The company’s constant regulatory compliance efforts helped them acquire important e-money, banking and crypto licenses which contributed to their accelerated expansion into new markets, making it the fastest growing technology company in Europe with a valuation of $33 billion.

Revolut’s listing of EGLD will introduce a wider audience to the frictionless payments at the core of Elrond’s vision, giving a new generation of digital natives a token that is used to fuel and make the seamless transfer of any type of value accessible to anyone, anywhere.

“The most innovative and disruptive startups in the fintech field gravitate towards crypto, bringing along unique talent pools and fully engaged communities. When you add to this a vision that transcends its own product and industry, you get a game changer. Elrond is such a project. That’s why we are excited to be able to offer EGLD to Revolut’s customers and help them accomplish their vision of an inclusive global financial system.” said Beniamin Mincu, Elrond Network CEO.

About Elrond

Elrond is the internet-scale blockchain, designed from scratch to bring a 1000-fold cumulative improvement in throughput and execution speed. To achieve this, Elrond introduces two key innovations: a novel Adaptive State Sharding mechanism, and a Secure Proof of Stake (PoS) algorithm, enabling linear scalability with a fast, efficient, and secure consensus mechanism. Thus, Elrond can process upwards of 15,000 transactions per second (TPS), with 6-second latency, and negligible cost, attempting to become the backbone of a permissionless, borderless, globally accessible internet economy.

About Revolut

Since launching in 2015 in the UK, Revolut has expanded significantly beyond its origins as an FX product, adding new features and services, including salary advances, instant peer-to-peer payments, budgeting controls, and FDIC insurance.

Headquartered in London, with 5,000 people in 23 offices, Revolut is now one of the most significant Fintech communities in the world, with over 20 million customers globally. Since its launch, Revolut has raised over $800 million in funding and processed more than 1bn transactions worth over $130bn.