The Future of Real Estate Is Onchain

How fractional rental income is creating a new asset class for everyday investors

Rental income has always been one of the most consistent ways to build passive income. Traditionally, though, accessing it meant buying property, taking out loans, navigating legal systems, and managing tenants. Even modern alternatives like real estate funds still involve high minimums and long lock-up periods.

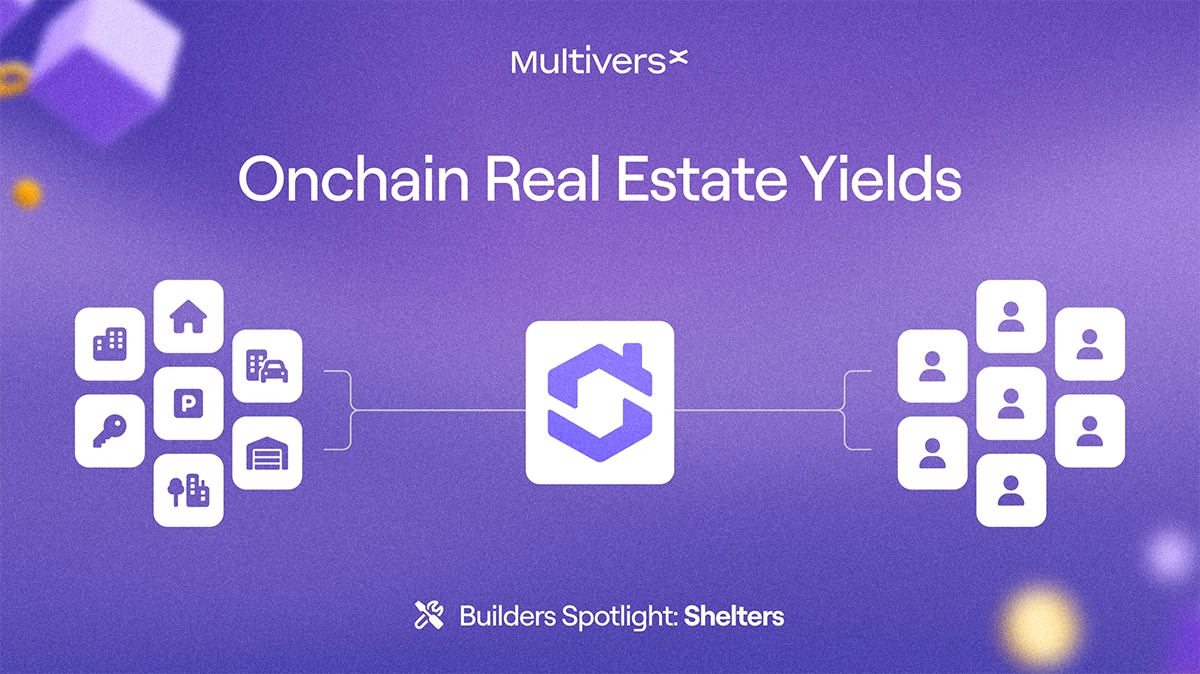

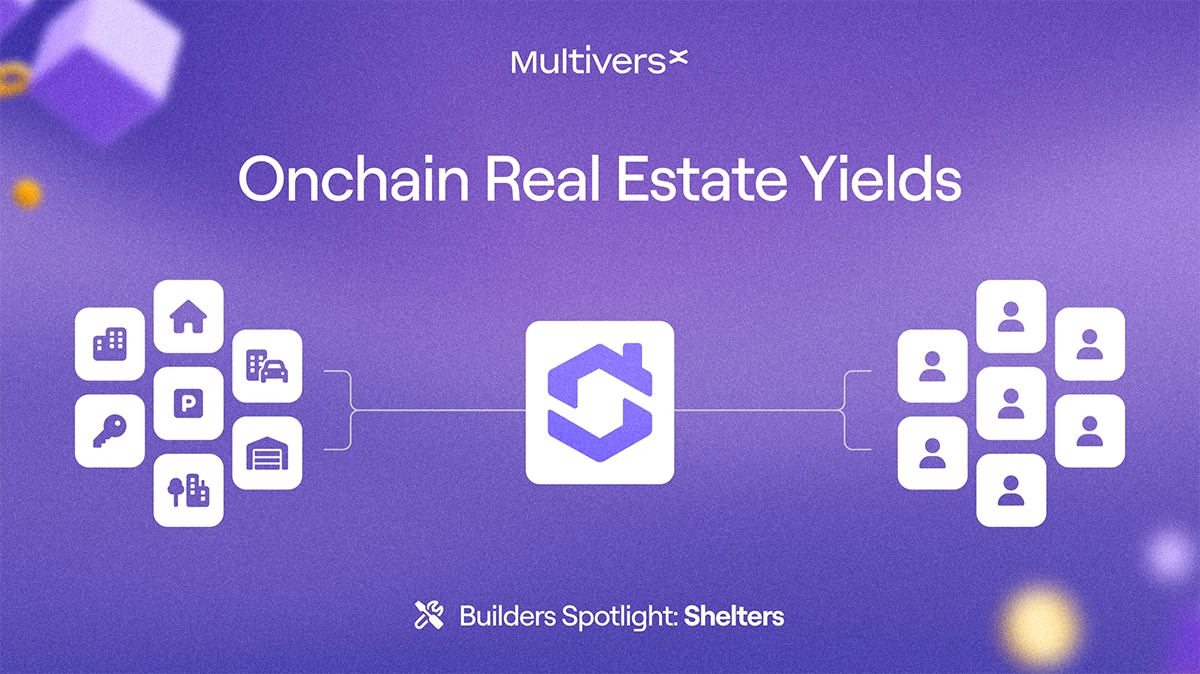

A new approach is needed to make this process radically more accessible. Instead of owning property, you should be able to invest directly in the income it produces. In this way, rental yield becomes the product itself, and all you have to do is choose from available properties that are already managed and rented out, buy a fraction of their monthly income, and start earning your share.

This shift is possible, and it’s blockchain infrastructure that powers it. By recording ownership and distributing payouts on-chain, the process becomes faster, cheaper, and fully transparent. There’s no waiting on paperwork or third-party intermediaries. The moment you invest, you gain direct access to a live revenue stream secured by verifiable, digital records.

Platforms like Shelters, built on MultiversX, are already offering this experience. Everything from property management to payout automation runs on blockchain rails, while users interact with a clean, intuitive interface that works with traditional tools like bank transfers, PayPal, and digital wallets. Real properties are producing income today, and everyday investors are participating on their own terms.

What Fractional Rental Yield Looks Like in Practice

Let’s look at a practical example.

A fully managed apartment in a European city generates €1,000 in rental income each month. That income is divided into 10,000 digital shares, each priced at €10. When you purchase 100 shares, you receive €10 in rent every month (excluding fees/expenses for simplicity) automatically, and without delays.

It works like a subscription payout. Rent is collected, your portion is calculated, and the funds are delivered in the format you choose. Every transaction is secured and recorded by the blockchain, ensuring transparency, traceability, and full ownership from the moment you invest.

The simplicity is what stands out. You can adjust your portfolio as you go, trade your shares on open marketplaces, and rely on a system that was designed for digital scale. This is real income, flowing from real properties, already on-chain and already working.

A Scalable Model for Every Type of Investor

This model opens new possibilities for a broad range of investors.

You can start with just €10, grow your exposure gradually, and build a portfolio that spans cities, property types, and risk profiles. Income arrives each month, recorded and distributed without friction or delays. The assets are real, the yield is stable and the experience is built to support both first-time users and long-term portfolio builders.

Everything behind the scenes, property selection, tenant management, and maintenance is handled by Shelters and its partners. Blockchain automates what used to be manual: ownership, accounting, and income distribution. You stay focused on results, while technology ensures that what you see is what you own.

"At Shelters, we’ve built a system where blockchain truly enhances the investor experience instead of complicating it. With MultiversX, transactions are near-instant, fees are ultra-low, and ownership is direct and transparent. Whether you invest €10 or €10,000, you get the same secure, seamless access to real, income-producing assets with monthly payouts, full traceability, and new possibilities like transferring your fractions at any time." – Adrien Vandenbossche, CEO of Shelters

MultiversX enables this model to scale. Its infrastructure supports high throughput, ultra-low fees, and direct wallet-based ownership, making micro-investing on Shelters practical. This allows thousands of small investors to participate in income-generating real estate with the same confidence and clarity as institutional players.

A New Standard for Real Estate Participation

Fractional rental income does more than open doors to a new category of investors. It creates a new category that’s simple, programmable, and accessible by design. What used to be slow and opaque is now fast, transparent, and easy to engage with. Blockchain turns real estate from a static asset into a flexible, digital-native experience.

You choose how much to invest. You receive monthly payouts. You grow your exposure at your own pace. And you do it all with direct access to assets that live on-chain, backed by real-world activity and managed by experienced teams.

This is how real estate evolves. With platforms like Shelters and infrastructure like MultiversX, the shift is already happening.

Explore more at shelters.finance