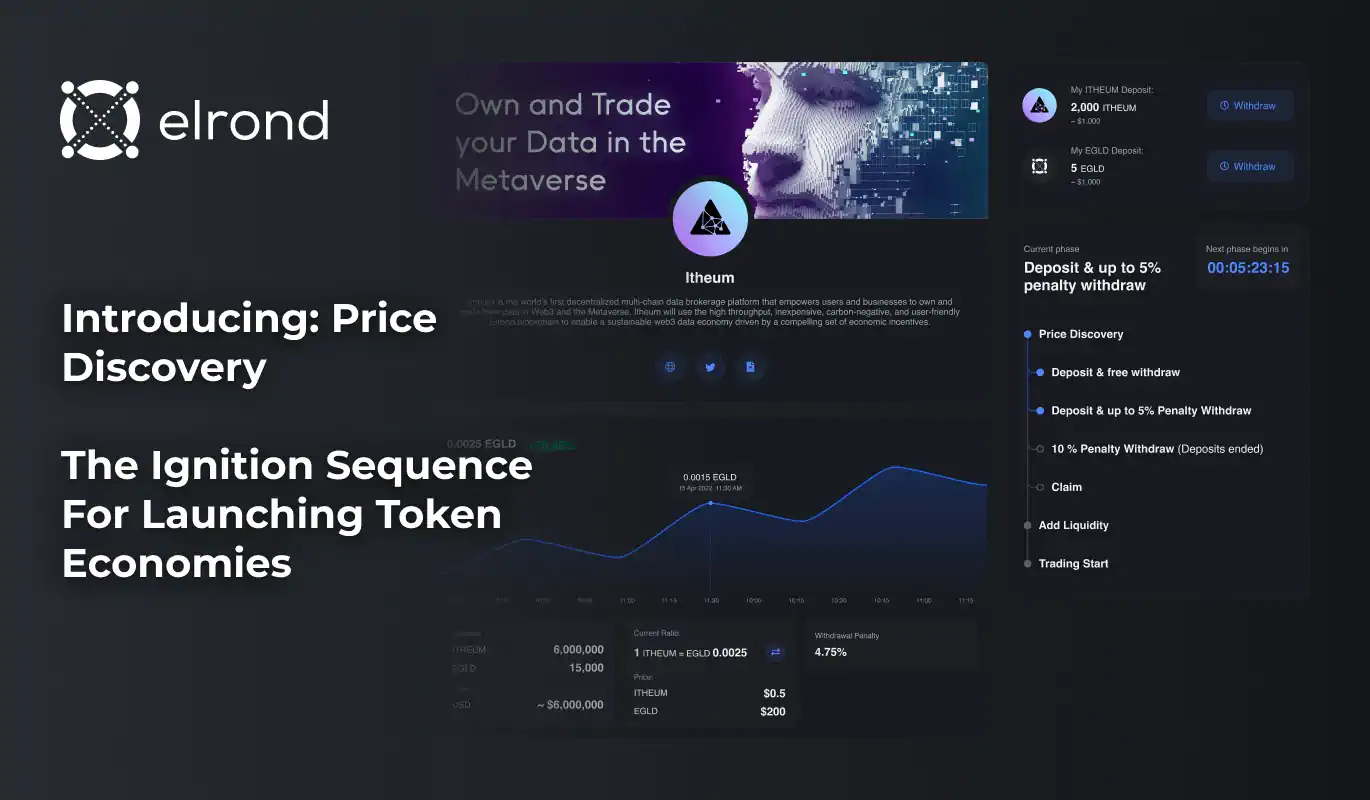

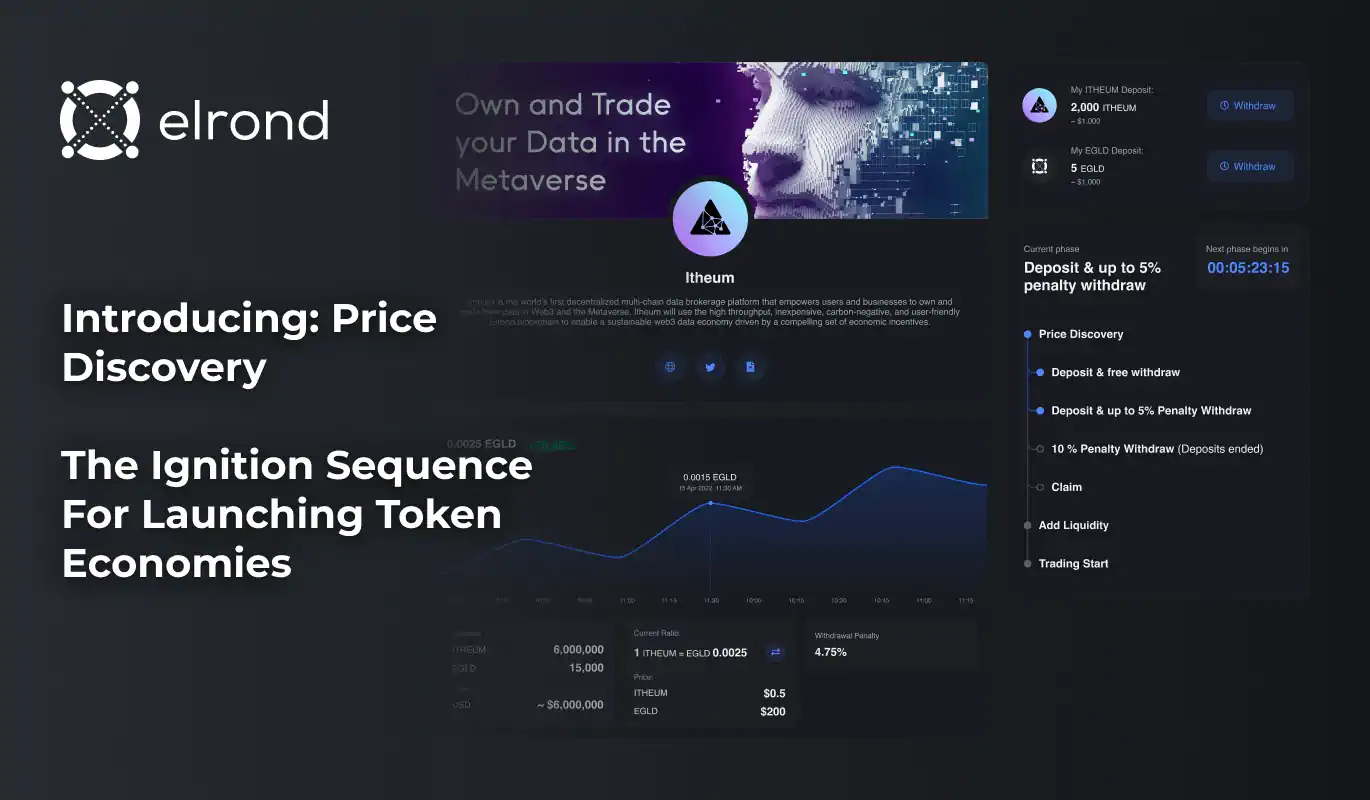

Introducing Price Discovery, The Ignition Sequence For Launching Vibrant Token Economies On The Maiar DEX

A token getting listed on an exchange for the first time is a crucial moment in the lifecycle of any project. It naturally creates excitement amongst market participants, who want to join projects that have strong value propositions and significant potential as early as possible.

When this listing follows a highly successful public sale, where the demand far exceeds the available supply, things can become that much more interesting.

So in anticipation of the excitement around the Itheum initial listing on the Maiar DEX, and drawing on the lessons learned from the holoride listing, we have devised a new price discovery mechanism.

It is created to help tokens find their right value in the market while aligning interests and giving everyone a fair chance of participating in the early stages of a new token economy.

This mechanism is part of the broader listing process, which we can break down into three different stages:

- Price Discovery

- Adding Liquidity

- Trading Start

They have all been redesigned to fit the new model. Let’s review them in order.

Price Discovery

In this phase, participants will deposit tokens into a smart contract: EGLD (to buy ITHEUM) and/or ITHEUM (to sell for EGLD). Based on the amount of EGLD and ITHEUM deposited in the smart contract at the end of this stage, the EGLD/ITHEUM ratio is established.

At the end of the period, those who deposited EGLD get locked-ITHEUM tokens, and those who deposited ITHEUM get locked-EGLD tokens. Everyone will have swapped observing the same price, that was “discovered” in this stage.

The locking mechanism is applied to the resulting tokens for ~2 days post listing, to reduce the incentives for speculators, and create a much stronger priority for longer term contributors.

Price discovery itself will have 4 different phases, as follows:

Phase 1: Buyers of Itheum can deposit EGLD, and Sellers of Itheum can deposit ITHEUM tokens in the smart contract.

As the amount of tokens in the smart contract changes, the new price is updated, based on the EGLD/ITHEUM ratio.

Withdrawals are possible in this phase without a penalty.

Phase 2: Similar to Phase 1, deposits are possible, but withdrawals now carry a penalty, which gradually increases over time from 0% until 5%.

This is to discourage attempts of price manipulation from those who deposit large amounts of tokens to drive the price up or down, and then withdraw at the last minute.

Phase 3: Deposits are no longer possible, and withdrawals now carry a fixed penalty of 10%.

Penalties accumulated in Phase 2 & 3 remain in the smart contract and contribute to setting the final ratio.

Phase 4: The Price Discovery phase ends, and the ratio of EGLD/ITHEUM is established. Withdrawing the initial deposits is no longer possible. Participants in price discovery can now redeem their purchase as locked tokens.

These locked tokens can’t be traded for 3 days, to further avoid volatility right after the price discovery period ends and trading begins. However, the locked tokens can be added as liquidity.

Adding Liquidity

In the next stage, owners of the newly locked-ITHEUM and locked-EGLD tokens, as well as owners of regular ITHEUM and EGLD, can deposit liquidity at the EGLD/ITHEUM ratio established in the previous phase.

Providing liquidity after the price discovery greatly reduces impermanent loss for initial liquidity providers, and provides a more solid starting point for the token to make its trading debut.

To further incentivize liquidity provision in this phase, liquidity providers will be able to earn a very significant reward of ~1000% APR in the first week following the trading start.

Trading Start

Once the price discovery is done and liquidity is provisioned, trading can start. It is also important to mention that in the initial phase of trading start, traders will receive tokens that are locked for ~3 days. This is to further create the room for long term supporters to engage with the token, while disincentivizing speculation.

Example Scenarios

To better illustrate the Price Discovery mechanism, let’s look at a few hypothetical scenarios.

Scenario 1:

- EGLD price $200 USD (assumption)

- Initial EGLD/ITHEUM ratio 1:5000

- Total EGLD deposited: 50,000

- Total ITHEUM deposited: 50,000,000

- Final EGLD/ITHEUM ratio 1:1000

- Resulting ITHEUM price $0.2

- Someone who deposited 1 EGLD will get 1000 locked ITHEUM

- Someone who deposited 5,000 ITHEUM will get 5 locked EGLD

Scenario 2:

- EGLD price $200 USD (assumption)

- Initial EGLD/ITHEUM ratio 1:5000

- Total EGLD deposited: 75,000

- Total ITHEUM deposited: 30,000,000

- Final EGLD/ITHEUM ratio 1:400

- Resulting ITHEUM price $0.5

- Someone who deposited 1 EGLD will get 400 locked ITHEUM

- Someone who deposited 5,000 ITHEUM will get 12.5 locked EGLD

Important next steps

The price discovery mechanism is being prepared for public testing in a special Battle of Yields event, where the community will get a first-hand impression of the process and will be able to directly engage with it, in a simulation of the upcoming Itheum price discovery mechanism.

This will allow us to validate our assumptions and fine tune parameters such as penalty percentage, token lock time or phase duration, so consider the numbers above as estimates and subject to further adjustments.

Stay tuned for the announcements over the coming days, which will bring more details about the process and next steps.

In the meantime, make sure you’ve read the rationale megathread for important insights: https://twitter.com/beniaminmincu/status/1510225934296698882

We’re here to back the most ambitious teams, solving hard problems, with significant global impact. We’re also here to share this unique opportunity with the passionate Elrond community.

There will be more improvements. More challenges. And new things to explore.

But this, we believe, is already a big step forward.

One taking things to the next level.

For startups, and community. Together.

Let's roll.