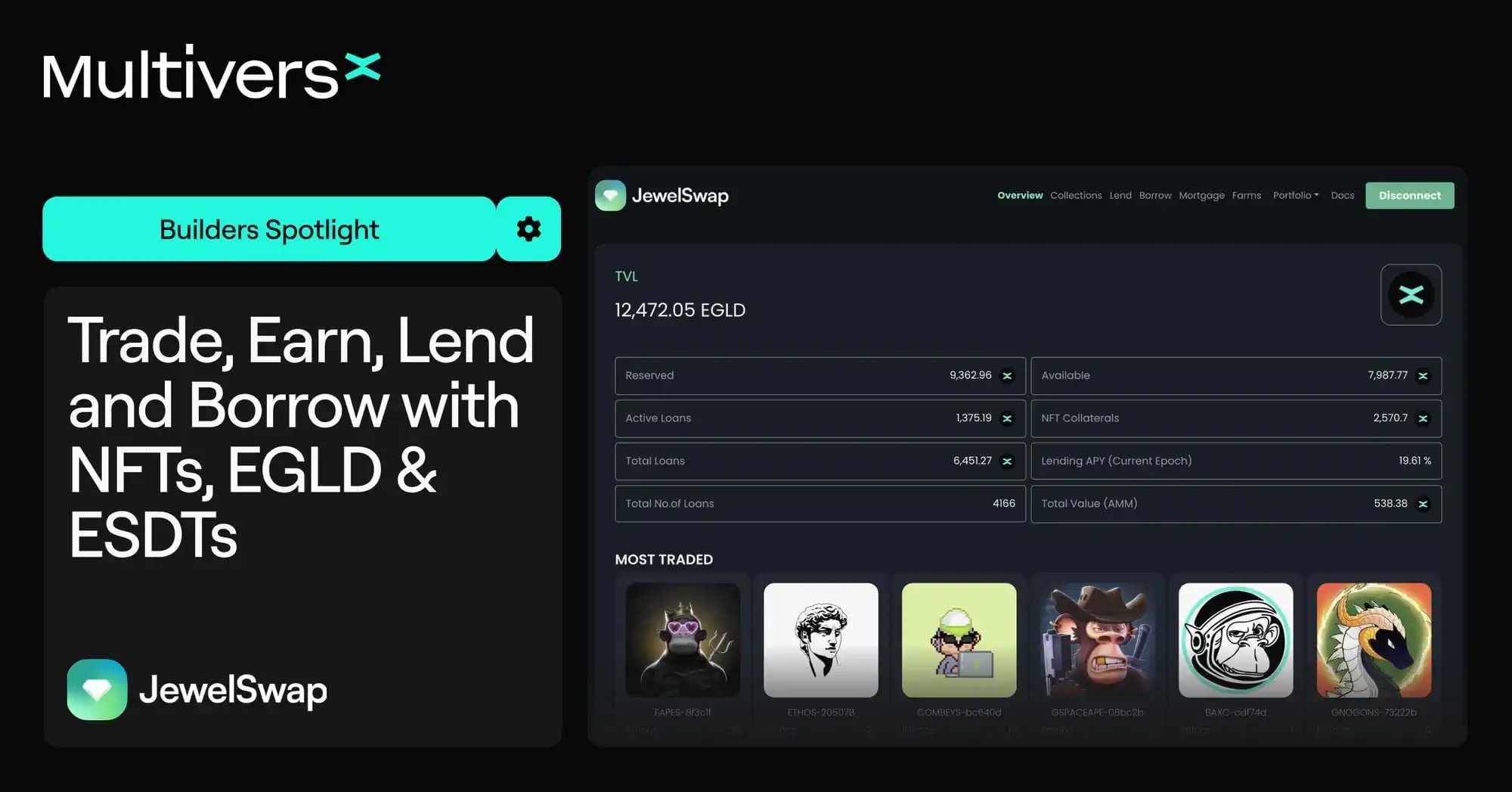

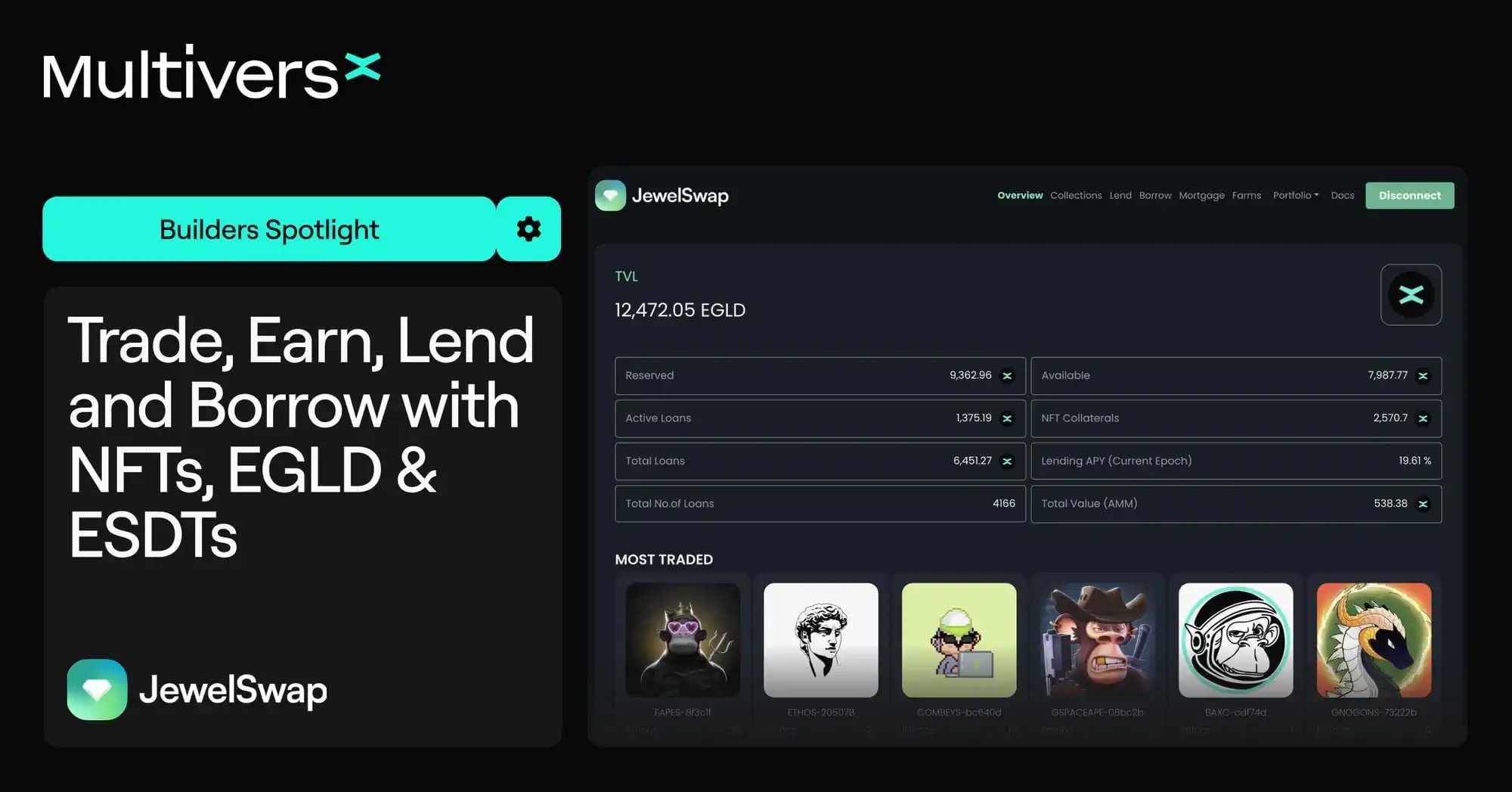

Builders Spotlight: Lend and borrow EGLD and other MultiversX assets in NFT-based DeFi use cases via JewelSwap

JewelSwap has managed to deploy multiple products on MultiversX in a relatively short period of time, amplifying NFT utility and value and expanding DeFi opportunities available on our network.

Their important additions to our ecosystem have quickly gained traction, consequently capturing a large TVL level of over 13,000 EGLD. Their most used product allows users to supply liquidity with EGLD, popularly referred as lending, and earn interest on fees paid by loan borrowers.

They have expanded the lending protocol to include NFTs and other MultiversX tokens, which facilitated more primitives to be built on top, such as NFT Mortgage. It makes it possible to buy a non-fungible token without having to pay the full market price, borrowing the remaining amount and covering it later on.

JewelSwap also makes use of the AshSwap protocol to offer leveraged yield farming. Through it, users can increase their farming positions via borrowing, and earn yield on both the collateral amount and borrowed amount.

Their product suite is expanding far beyond these and they are constantly adding new features. A great example of relentless work and productive tracking of what the ecosystem needs.

About JewelSwap

JewelSwap built the first NFT peer-to-pool Lending Liquidity Protocol and NFT AMM Marketplace on MultiversX, both trustless programmable through smart contracts. The Lending Liquidity Protocol generates liquidity for the NFT and DeFi ecosystem by allowing users to lend and borrow from the protocol using their NFTs as collateral.