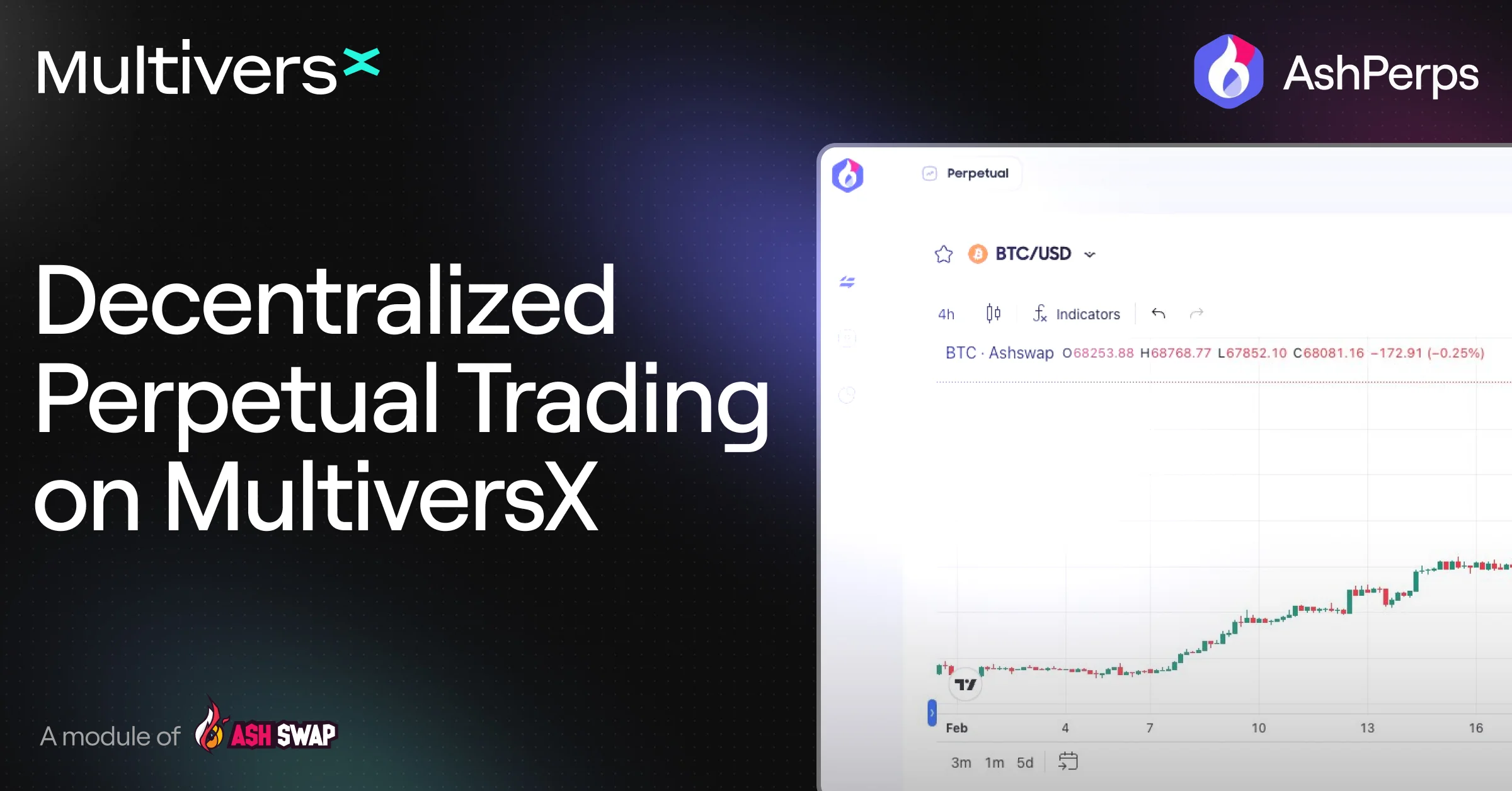

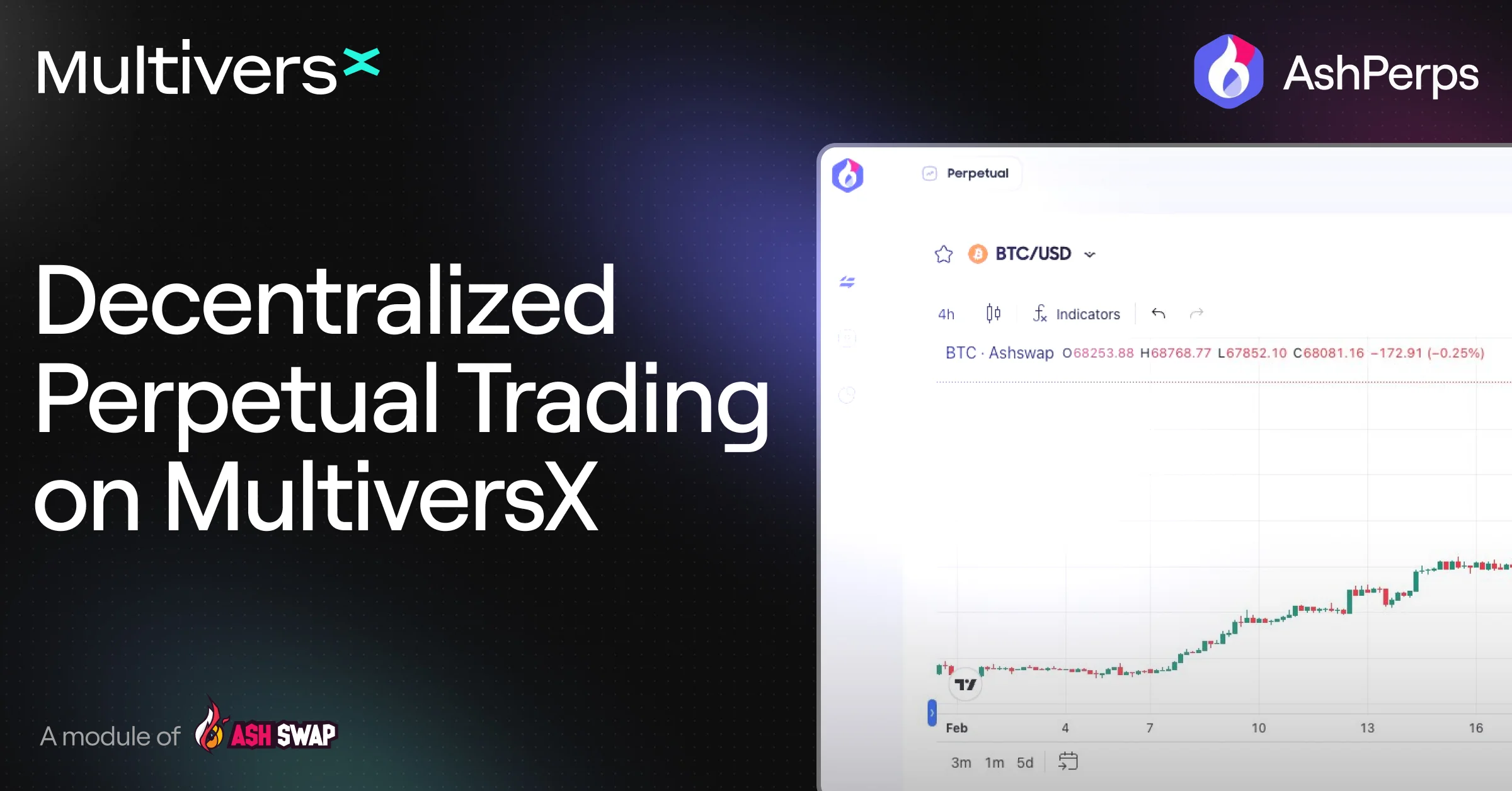

AshPerp Launches On-Chain Leveraged Trading On MultiversX

AshSwap was one of the first startups to debut on xLaunchpad. Now, after more than $130M cumulative volume to date and a heated bribes war season on its stableswap protocol, the pioneering DeFi platform is ready to evolve into a much bigger hub on MultiversX.

Announced to launch on the 11th of March, together with a $10,000 kick-off campaign, its new module will offer decentralized perpetuals.

Through AshPerp, traders will be able to access leveraged exposure as high as 100x to assets such as EGLD, BTC and ETH, without an expiration date and also without holding the underlying tokens.

Its trading activity is efficiently conducted via a stablecoin liquidity pool and oracle pricing from multiple sources, including data aggregated from the 100+ providers of Pyth Network. This synthetic approach comes with advantages in capital management, security, composability and the possibility to add support for assets that are not native to MultiversX (even Forex or Equities).

Decentralized by design and enabling self-custody of funds, AshPerp also features a 1 click-trading flow for a better and faster trading experience that abstracts away the particularities of the blockchain and mirrors the UX of centralized peers.

The market for on-chain perpetuals has recently grown considerably, both in volumes and users. Building on top of MultiversX, AshPerp is perfectly positioned to capture significant market share and accelerate this ecosystem opportunity.

About AshPerp

AshPerp is the first decentralized perpetual trading platform on the MultiversX blockchain, offering a liquidity-efficient, powerful, and user-friendly trading experience for a wide range of assets (crypto, forex, etc.) with high leverage. In short, you can consider AshPerp a “decentralized version of futures trading platform on CEXs such as Binance, OKX, and Bybit …”