DeFi Innovation: Multi-Asset Liquidity Pool for Options with eGLD & FNX by FinNexus

We’re excited to announce that eGLD will be part of a revolutionary multi-asset liquidity pool for Options, which our DeFi partner FinNexus is building to further increase the efficiency of the multi-trillion dollar derivatives market.

Options are financial derivatives that offer their buyer the right to purchase an underlying asset at a specified price over a time period. The options market is worth multiple trillions of dollars each year, with DeFi & blockchain technology positioned to capture a part of it, thanks to increases in efficiency and decrease of costs.

FinNexus will deploy their FPO - FinNexus Protocol for Options - v1.0 on Elrond. Liquidity for the pool will be provided in native eGLD and FNX tokens issued on the Elrond blockchain.

When pooled, liquidity accumulates from all market participants simultaneously and automatically. The risks and premiums are also shared equally across the entire group of liquidity providers so that no individual participant is at high risk and all participants can share in the rewards.

Multi-Liquidity Pools Explained

The Multi-Asset Single-Pool is a revolutionary concept for eGLD and FNX token holders to gain exposure to a variety of bespoke cash-settled options positions on a variety of assets, initially BTC and ETH.

Advantages of pooling:

- Reduces risk for writers — Under the pooled liquidity model, retail investors may enjoy the high rates of return afforded to individual options writers, while also being protected from the risk of any single option contract, as the risk is spread amongst all options generated from the pool. This structure gives retail investors the opportunity to profit in ways that have previously been limited to financial professionals. FNX and ERD token holders that stake their tokens into the FPO v1.0 pooled liquidity model can earn a high rate of return with relatively low risk.

- Lower costs and increased liquidity — Since collateral and liquidity is shared amongst all the options backed by the FNX and ERD liquidity pool, the cost for creating individual options is much lower. In turn, the amount of available collateral backing any individual option is much higher.

- Greater variety of option types — Due to the increased liquidity and lower costs mentioned above, this model allows for the creation of a much greater variety of different option types than under the vanilla model. More variety should lead to more buyers, which should lead to an even greater variety of options, establishing a virtuous cycle.

Pooled Options Model Basics

- A single collective pool is created with ERD and FNX tokens. The monolithic pool then acts as the seller of all the options. The protocol may accept other crypto assets as collateral for the pool in later versions and/or on different blockchains.

- Options will not be tokenized. Rather they will be recorded in smart contracts.

- The initial underlying assets are BTC and ETH, but can be extended to any assets. The long-term vision for the FinNexus Crypto Supermarket includes the tokenization of bespoke options positions on any cryptocurrency, stock, physical assets, index or really any asset with a dynamic price feed.

- Options will be American type and can be exercised or traded any time freely before expiration against the single liquidity pool on the chain where the exposure is held. Some restrictions may be understandably added in the first few iterations here to control risks.

- Pool shares are tokenized and sent to pool participants as certificates.

- The pool size is measure by the net value in USD, which changes according to the distribution of premiums, moneyness of options, exercising, sell-back, and other associated features.

- The buyers can choose option characteristics according to their needs. The associated premium will be calculated using algorithms in the smart contracts, dynamically and automatically.

- Protocol security will be maintained by setting the collateral level high enough to guard against black swan events. This collateralization ratio has not been determined yet and will likely be experimented with to find an optimal level.

- ERD and FNX in the pool can be withdrawn anytime, provided the liquidity is not fully locked by the existing option contracts. Again, some restrictions may be added in the first version.

The codes is open to check on https://github.com/FinNexus/FinnexusOptions_V2

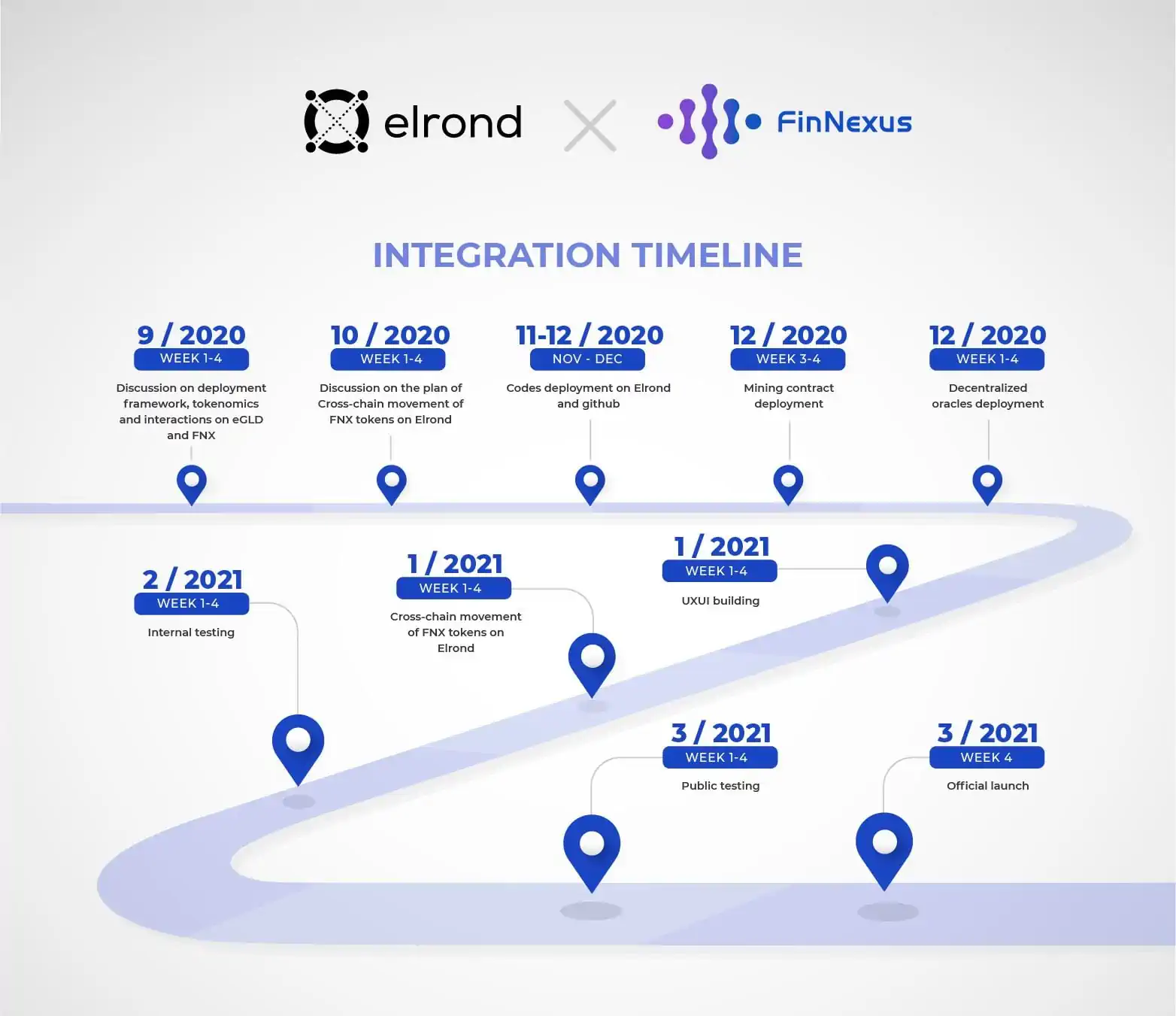

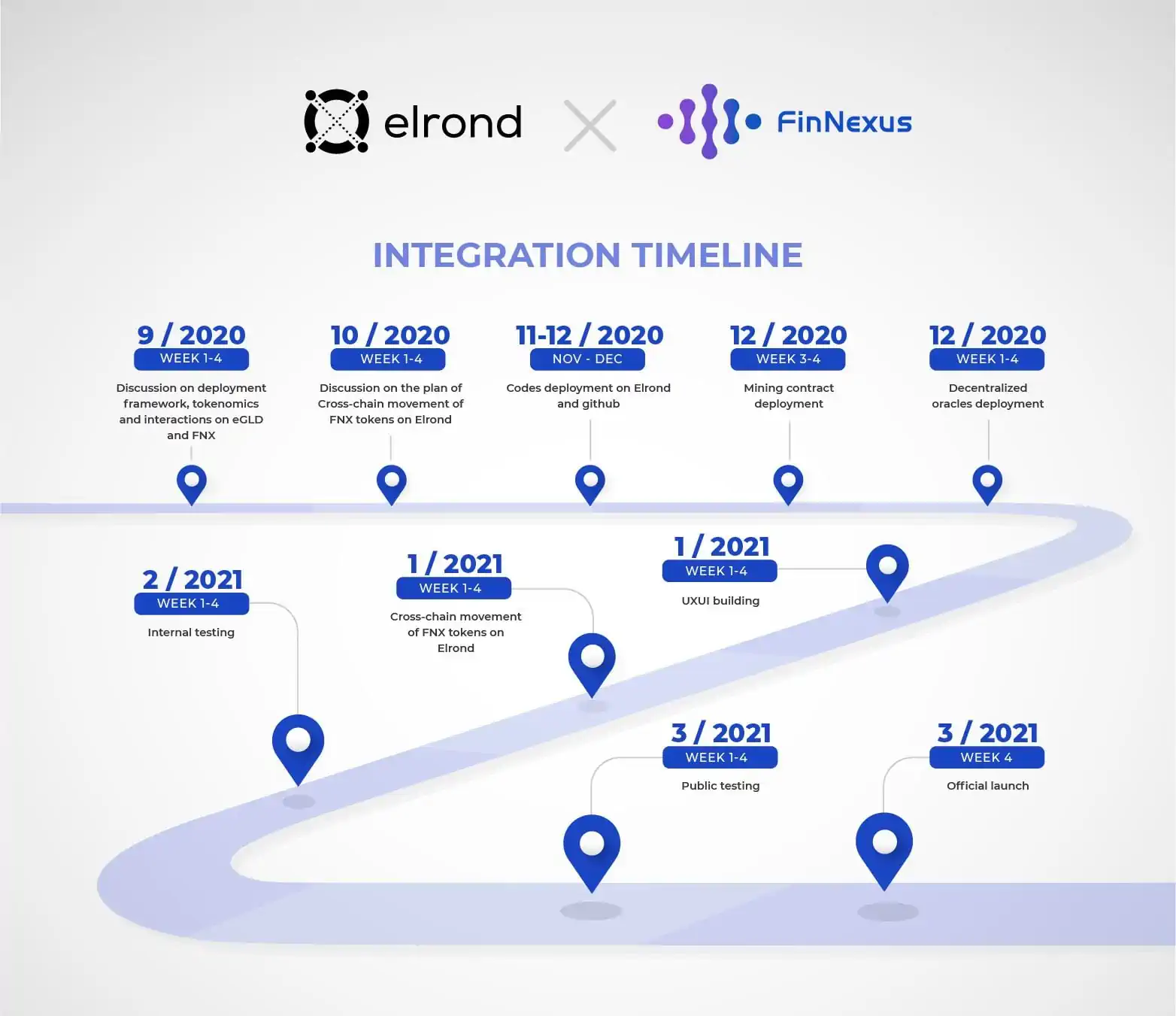

Collaboration Outlook

The two partners are already engaged in building and delivering this innovative DeFi scenario for the multi-trillion-dollar markets. The result will provide a highly efficient alternative to Options as financial instruments. It will bring an efficiency boost for those already engaging with these instruments, as well as increase access to investors looking to diversify in an area that was otherwise only available for large players.

About Elrond

Elrond is a new blockchain architecture, designed from scratch to bring a 1000-fold cumulative improvement in throughput and execution speed. To achieve this, Elrond introduces two key innovations: a novel Adaptive State Sharding mechanism, and a Secure Proof of Stake (PoS) algorithm, enabling linear scalability with a fast, efficient, and secure consensus mechanism. Thus, Elrond can process upwards of 10,000 transactions per second (TPS), with 5-second latency, and negligible cost, attempting to become the backbone of a permissionless, borderless, globally accessible internet economy.

About FinNexus

FinNexus is building an open finance protocol to power hybrid marketplaces that trade both decentralized and traditional financial products. The first iteration of FinNexus will be a marketplace for hybrid decentralized / traditional financial products, including tokenized assets with value based on real-world cashflows, and a decentralized options protocol.